In an industry where timely communication and accurate information are critical, IVR systems enable insurers to serve customers quickly and efficiently, from policy inquiries to claims assistance. By automating routine interactions, these systems free up human agents to handle more complex cases while ensuring customers receive support 24/7.

This article explores how IVR systems work, why they’re increasingly vital for insurance companies, and the tangible benefits they bring to customer experience and operational efficiency.

Key Takeaways

- IVR (Interactive Voice Response) systems help insurance providers deliver 24/7 support, automate high-volume tasks like claims and payments, and reduce call center strain.

- Key benefits include faster claim submissions, reduced wait times, improved first-call resolution, and lower operational costs, all while boosting customer satisfaction.

- Integrations with CRM and AI tools enable personalized experiences, intelligent routing, and secure data handling, making IVR a critical asset for modern insurers.

Understanding IVR Systems in the Insurance Industry

Interactive Voice Response (IVR) is an automated telephony technology that allows callers to interact with a company’s systems via voice prompts or keypad selections. Instead of waiting for a live agent, customers navigate through a menu of options to get the information or service they need. While IVR has been widely adopted across sectors, it holds unique potential in insurance, where large volumes of repetitive inquiries can overwhelm call centers.

IVR systems create a dual advantage. On the customer side, they reduce wait times, offer self-service options, and improve access to information. On the business side, they lower call handling costs, free up agents for complex tasks, and generate valuable data on customer behavior.

For example, imagine a customer who has just been in a minor car accident late at night. Instead of waiting until morning to speak to an agent, they call their insurance company and are immediately guided by an IVR system. Within minutes, they can report the incident, upload claim details via a secure link, and receive a reference number for follow-up — all without holding for a live representative. By automating routine interactions like this, IVR frees up human agents to handle complex cases while ensuring customers receive support 24/7.

Key Benefits of IVR Systems for Insurance Companies

IVR systems give insurance providers a competitive edge by combining round-the-clock availability with streamlined workflows. Here’s how IVR transforms the insurance experience, both for customers and for the business.

Improved Customer Service Availability

Insurance needs don’t follow a 9-to-5 schedule. With IVR systems, customers can access policy and claims information anytime, even after hours or on weekends. Whether checking coverage details before a trip or reporting a claim after a storm, policyholders receive consistent support without waiting for an agent. This 24/7 availability builds trust and reduces frustration during high-stress situations.

Efficient Call Routing and Reduced Wait Times

Instead of waiting on hold or bouncing between departments, callers use IVR prompts to reach the right team immediately, whether that’s claims, billing, or policy updates. By minimizing transfers and directing customers to the right resource on the first try, IVR improves first-call resolution rates and significantly cuts down on average handle time.

Faster Claims Processing

Claims are the heart of any insurance operation, and delays can erode customer confidence. IVR systems allow customers to submit initial claim details quickly, upload documentation through secure links, and receive automated status updates. This reduces administrative workload for agents and shortens turnaround times for claim settlements.

Self-Service Options for Common Inquiries

IVR technology empowers customers to complete routine tasks on their own, such as policy renewals, premium payments, or requesting coverage documents. With automated menus, they can check claim status, update contact details, or request ID cards without waiting for an agent, reducing call center congestion and improving customer experience.

Enhanced Customer Satisfaction and Retention

When customers can resolve issues faster, satisfaction scores naturally rise. IVR systems reduce wait times, provide consistent experiences, and offer multilingual support for diverse customer bases. Smoother, more efficient interactions help retain existing policyholders and differentiate an insurer in a crowded marketplace.

Practical Applications of IVR in Insurance

Instead of relying solely on human agents to handle routine calls, insurers now use IVR systems to automate everything from policy information lookups to payment reminders, reducing bottlenecks and making the customer journey smoother at every touchpoint. Here’s how insurance companies are using IVR in real-world scenarios.

Policy Information and Account Management

With IVR, policyholders can instantly access details such as policy numbers, renewal dates, or coverage summaries. This not only saves time for customers but also reduces the administrative workload on agents who would otherwise answer routine inquiries.

Payment Processing

Secure IVR payment gateways allow customers to make premium payments directly over the phone. Automated reminders notify them when payments are due, and instant confirmations provide peace of mind. This improves cash flow for insurers while offering a frictionless experience for customers.

Claims Assistance

IVR systems can guide customers step-by-step through the claims process. From initial submission to automated follow-up updates, customers know exactly where they stand. This transparency builds trust and helps insurers resolve claims more efficiently.

Emergency Assistance Lines

During high-stakes situations — such as auto accidents, natural disasters, or travel emergencies — IVR systems can fast-track urgent requests. Customers are routed immediately to emergency lines or high-priority claim teams, ensuring that critical cases receive prompt attention.

Lead Generation and Marketing Campaigns

Beyond service, IVR can support marketing efforts. Automated surveys help collect customer feedback, and pre-qualification scripts can identify promising leads before transferring them to agents. This allows sales teams to focus on high-value prospects and improve conversion rates.

Integrating IVR with Other Insurance Technologies

Modern insurance operations don’t run in isolation. IVR systems become far more powerful when integrated with other technologies, enabling personalized experiences, smarter routing, and secure data handling.

CRM Integration for Personalised Service

By connecting IVR systems to customer relationship management (CRM) software, insurers can automatically pull up customer data as soon as a call comes in. This allows the IVR to greet callers by name, tailor menu options to their policies, and log every interaction directly into the customer’s profile. Agents receive a complete picture before they even pick up the phone, resulting in faster and more effective service.

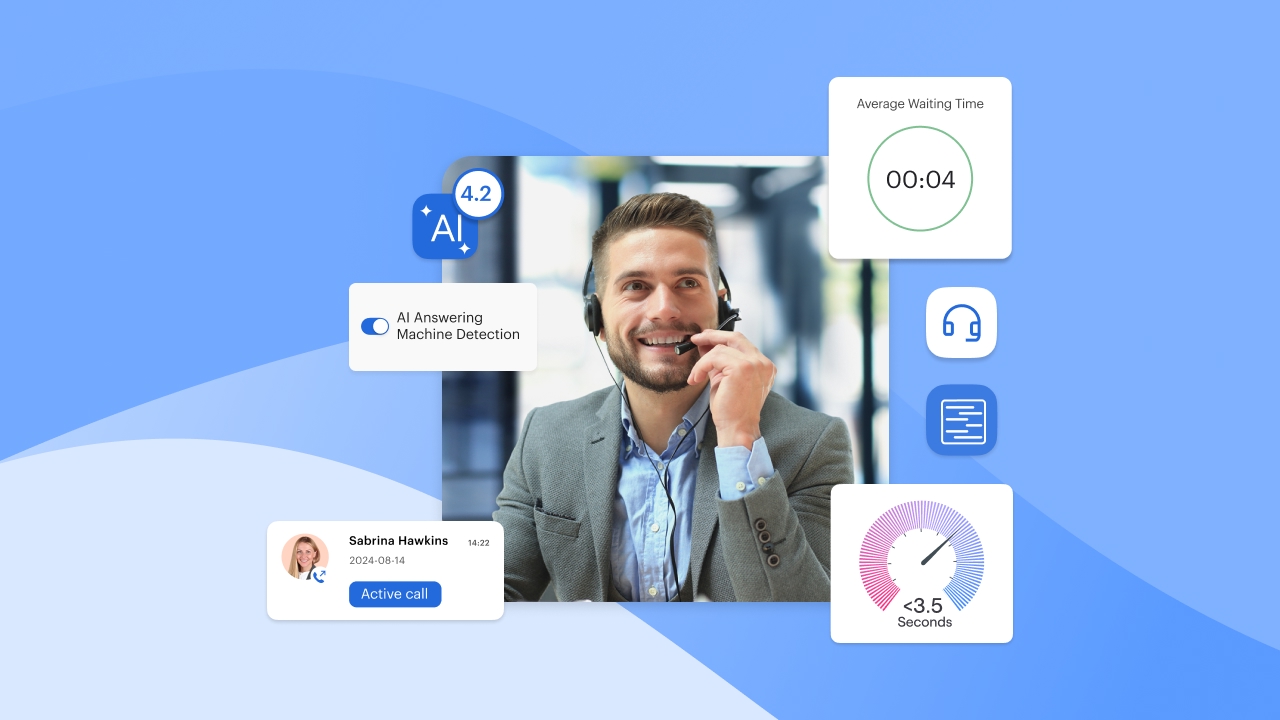

AI-Enhanced IVR for Smarter Interactions

Artificial intelligence takes IVR beyond simple menu trees. Using voice recognition, natural language processing, and sentiment analysis, AI-enhanced IVR can understand caller intent, predict needs based on history, and route calls to the most appropriate agent or automated workflow. This not only saves time but also reduces customer frustration by avoiding repetitive prompts.

Compliance and Data Security

Insurance companies handle sensitive personal and financial information, so data protection is critical. Modern IVR systems include encryption, tokenization, and secure payment processing to keep customer information safe. They can also be configured to meet strict regulatory requirements (such as HIPAA for health insurance or PCI DSS for payment data), helping insurers stay compliant while maintaining customer trust.

FAQs

What is the main advantage of IVR for insurance companies?

The primary advantage is 24/7 accessibility and automation. IVR systems handle routine inquiries — like policy information, claim status, or payment reminders — without agent intervention, freeing staff to focus on complex tasks and reducing operational costs.

Can IVR systems handle complex claim submissions?

Yes. Modern IVR platforms can guide customers through step-by-step claim submissions, capture essential details, and provide automated status updates. More complex cases can be escalated to a live agent with all data already collected, reducing handling time.

How does integrating IVR with CRM improve service quality?

CRM integration allows IVR systems to personalize the caller experience by pulling up customer profiles in real time. This means tailored menu options, faster routing, and a more seamless handoff to live agents — all of which improve first-call resolution and satisfaction.

Are IVR systems secure enough for processing payments?

Yes. Leading IVR solutions like Voiso’s use secure payment gateways, encryption, and tokenization to protect sensitive financial information. This keeps transactions compliant with industry standards such as PCI DSS and builds customer trust.

Can AI improve the effectiveness of insurance IVR systems?

Absolutely. AI enhances IVR by using voice recognition, natural language processing, and predictive analytics to understand caller intent, reduce repetitive prompts, and route calls more intelligently. This results in faster resolutions and a more human experience.

What types of inquiries are best handled through IVR?

Routine or high-volume inquiries such as policy information, premium payments, claim status checks, and document requests are ideal for IVR. This keeps agents available for complex, high-value interactions.

How can IVR reduce operational costs for insurance providers?

By automating routine interactions, reducing call transfers, and improving first-call resolution, IVR systems lower the number of agent hours needed per inquiry. This decreases overhead while maintaining, or even improving, service quality.