Nearly 60% of consumers say repeating themselves is the most frustrating part of a support interaction. That frustration usually starts with one thing: a transfer.

Transfer rate is often treated as a backend metric, something to monitor quietly but not question. But that percentage doesn’t just track call flow. It tells you how well your system listens, how clearly it routes intent, and how much trust you’re earning (or losing) on the way to resolution.

The formula is easy. Understanding what it actually measures, and what it misses, is where the real work begins.

Key Takeaways

- Transfer rate measures how often calls are handed off, but high rates often reflect broken routing logic, not complex issues.

- Customer trust erodes quickly when context is lost between transfers, Zendesk reports that just one transfer doubles the chance of negative feedback.

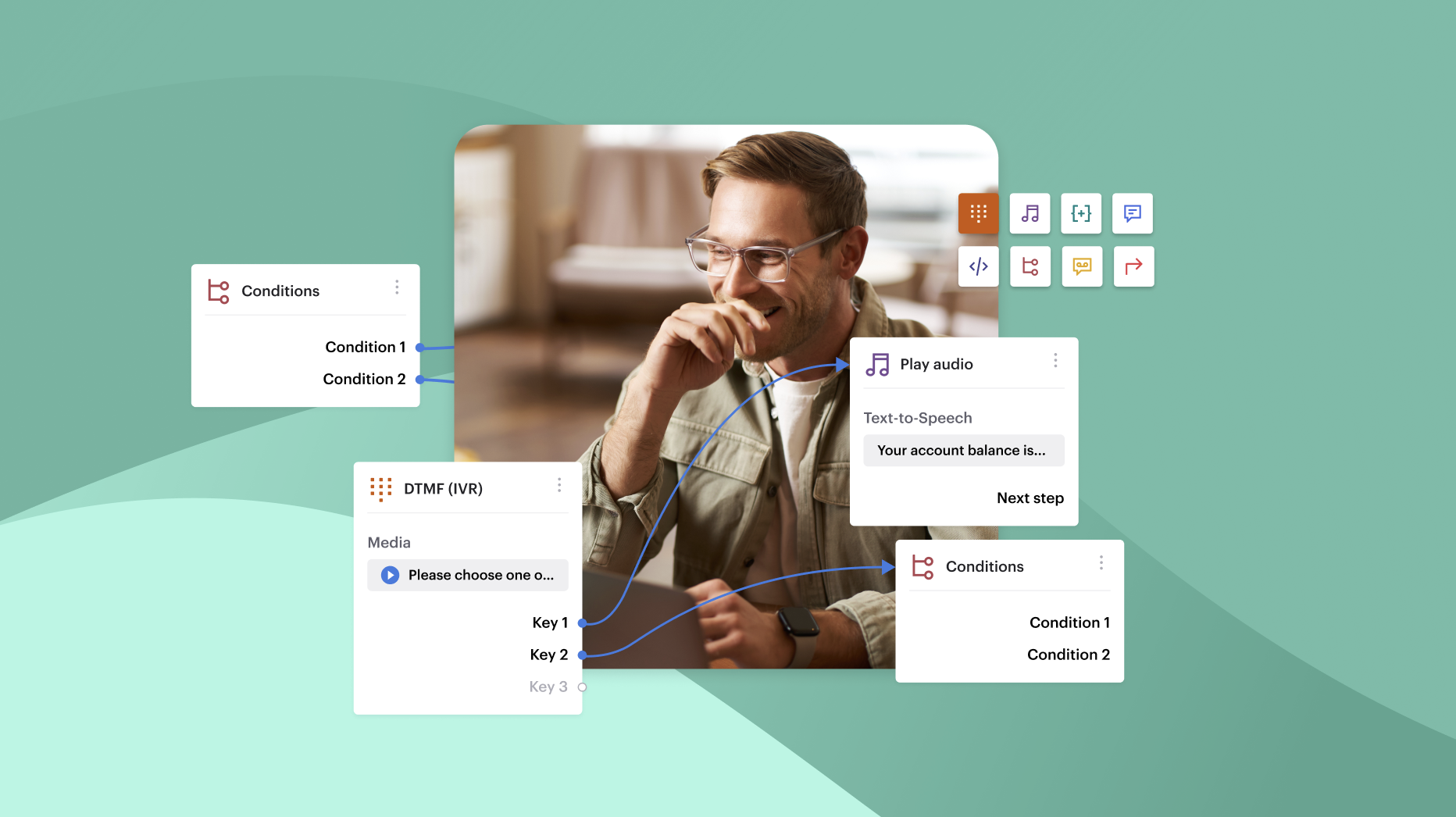

- Voiso reduces unnecessary transfers by combining AI-powered intent prediction, real-time queue diagnostics, and smarter IVR flows.

- Healthy systems prioritize resolution ownership and warm handoffs; the goal isn’t zero transfers, but zero confusion.

- Smart benchmarking by intent, industry, and call type leads to better routing decisions and higher First Contact Resolution (FCR).

What Transfer Rate Actually Measures and What It Leaves Out

Transfer rate follows a clean formula:

(Number of transferred calls ÷ total inbound calls) × 100

That part’s easy. What’s hard is trusting the denominator.

Not every call belongs in the count. A customer who gets disconnected in IVR and calls back five minutes later might appear twice. One interaction, two data points. Or a misrouted call shows up as two separate entries: one under “billing,” one under “support.” That bloats the total, drops the percentage, and tells the wrong story.

Hang-ups don’t always get counted. Some platforms exclude dropped calls before they reach an agent. Others group transfers as part of a “resolution journey” and compress them into a single metric. Either way, the math looks better than the reality it’s trying to describe.

And that’s the problem. Transfer rate hides pain. A “good” percentage just means fewer reported handoffs. It says nothing about how disruptive each one was, or whether the system made any sense along the way.

One clean transfer to the wrong department still wastes time. Two quick hops might feel like progress, but they usually signal a design problem upstream. Dashboards rarely show that.

Your system’s routing logic writes this metric

Transfer stats don’t start at the agent level. They begin where the call enters your system.

Most customers don’t transfer themselves, they get pushed. Bad routing turns that push into a pattern. When IVRs frame choices too narrowly, people guess. When CRM tags misclassify a customer’s history, the system routes based on old context. When departments are siloed, the call has no chance of reaching the right person on the first try.

Agents might handle the handoff, but they didn’t create the path that made it necessary.

And when routing logic favors speed over accuracy, the damage compounds. Calls land faster, but land wrong.

Common routing flaws that look efficient but hurt CX

- Oversimplified IVRs: Two or three options sound clean, but leave nowhere for edge cases to go. That forces unnecessary transfers.

- Static segmentation: Routing based on broad categories like “premium” or “first-time buyer” ignores intent. The wrong questions get answered first.

- Volume-driven overflow: Pushing calls to whoever’s free reduces hold time. But it guarantees rerouting once the mismatch becomes obvious.

- Assumptions about behavior: Just because someone opened a billing ticket last week doesn’t mean they’re calling about billing today.

Those patterns create smoother internal metrics. But they leave customers wondering if anyone actually understands why they called.

Example: Fast IVR → wrong department → multiple hops

A customer calls in about a double charge on their invoice. The IVR picks up quickly and offers two main options: “Technical Support” or “Account Services.”

They pick Account Services. Makes sense so far. But that route leads to a generalist who can’t adjust charges. The agent transfers them to Billing. The Billing agent notices it’s related to a failed promotional code and sends them to Marketing Ops.

Three departments. Three reps. Same issue.

None of it looks bad on the surface. The call gets answered fast. Each agent acts quickly. The system logs only two transfers. But from the customer’s perspective, they had to explain themselves three times to solve a single, simple problem.

That transfer rate? It won’t raise a flag. But the experience absolutely will.

Transfers Kill Trust Faster Than They Hurt Numbers

Repeating yourself = frustration amplifier

Customers don’t judge support by average handle time or SLA compliance. They judge by how many times they had to repeat themselves.

When someone gets transferred, the very first question they ask is “Do I need to explain this again?” If the answer’s yes, the experience just slipped from “tolerable” to “annoying.”

According to Zendesk’s CX Trends report, customers who experience just one transfer are twice as likely to leave negative feedback compared to those who weren’t redirected at all. Not because the agent wasn’t polite. Not because the issue didn’t get solved. They just didn’t want to rehash it.

That repetition erodes trust. Customers expect their context to follow them. When it doesn’t, they stop believing the company knows who they are, or why they called in the first place.

And once trust slips, CSAT doesn’t recover. Even a perfect resolution doesn’t erase the friction they had to push through just to get there.

Speed without context = failure in disguise

Contact centers love to brag about low wait times. But if a quick answer leads to a handoff, and that handoff leads to a reset, the win disappears.

A fast pickup doesn’t matter if it restarts the conversation. The real metric that tells the story? First Contact Resolution (FCR). That one shows whether the first agent handled the issue fully, without needing a handoff, escalation, or callback.

High-speed routing without context sounds efficient. But when customers get moved without their intent following them, the conversation splinters. And agents end up fixing the same problem twice.

Quick response ≠ resolved interaction. Speed buys you time. Context is what earns satisfaction.

High transfer rates ≠ high complexity

Leaders often assume transfer volume means they’re dealing with difficult issues. That’s rarely true.

In many cases, high transfer rates signal broken front doors, not complicated questions. It’s not that the customer’s asking something hard, it’s that the system couldn’t classify the request correctly. Or the agent wasn’t trained to own it end-to-end.

A BPO contact center running at a 28% transfer rate dug into the pattern. Nearly 70% of those transfers came from just three FAQs, all related to plan selection language in their IVR. Once they updated the phrasing and clarified agent responses, transfer volume dropped below 12% within six weeks.

The problem wasn’t complexity. It was confusing.

Fix the Real Problems, Not Just the Metric

High transfer rates rarely stem from agent gaps. They come from bad decisions upstream.

Routing by department feels tidy but misses nuance. Customers don’t call in asking for “Accounts Payable.” They ask, “Why was I charged twice?” Mapping IVRs around internal teams creates friction. Mapping around intent removes it.

Tagging helps, but only when it reflects real-world phrasing. Too many call centers rely on generic categories that hide root causes. “Billing Issue” could mean five different workflows, and send a customer down the wrong path five times.

AI can help untangle this, but only when used with restraint. It works well for pattern-heavy queries: refund requests, status checks, simple verifications. It breaks down when emotional tone or conversational ambiguity enters the mix. Human routing works better when the issue doesn’t fit clean categories, and agents are trained to probe for intent, not just keywords.

Use AI for clarity. Use people for judgment. The system should know the difference.

Build “resolution ownership” into your QA framework

Most scorecards reward productivity. That’s how agents end up transferring calls the moment they sense complexity. It’s not laziness, it’s survival.

Shift the incentives. Reward resolution, not just speed. Agents should own problems, not just answer phones.

Start with QA scorecards. Replace generic boxes like “adherence to script” with measurable resolution behaviors:

- Did the agent try to solve the problem before escalating?

- Did they confirm the customer’s issue was fully understood?

- Did they offer next steps if the resolution needed a follow-up?

Escalation should never mean “off my plate.” It should mean “let me bring in someone with more authority, and here’s what they already know.”

Ownership doesn’t require micromanagement. It requires permission. Train agents to ask better questions, trust their judgment, and take accountability for the handoff experience, not just the call they logged.

Visual: Transfer Rate vs. FCR Delta Across Departments

The mismatch between routing logic and actual resolution becomes painfully clear when viewed by the department. Here’s a real (anonymized) example from a mid-sized financial services contact center:

| Department | Transfer Rate | FCR (%) | Observed Issue |

| Billing Inquiries | 14% | 91% | Well-tagged, consistent routing |

| Plan Upgrades | 27% | 63% | IVR routes to Sales instead of Support |

| Refund Requests | 9% | 89% | AI classification + clear handoffs |

| Promo Complaints | 32% | 58% | Vague categorization + unclear policy |

| Password Resets | 5% | 96% | Fully automated, no transfers |

Departments with high FCR usually show low transfer rates and a clear routing structure. The ones with vague classification or fuzzy accountability suffer, no matter how capable the agents are.

Benchmark Smarter, One Transfer Rate Doesn’t Fit All

Intent changes everything

Transfer rate doesn’t live in a vacuum. Context defines whether a handoff is harmless or harmful.

Someone checking the status of a package might not mind a brief transfer. They’ve already got low emotional investment. As long as the update comes quickly, the routing doesn’t damage the experience.

Now take a different case: a customer calling about a suspicious bank charge. Every second matters. A single transfer, especially one that requires them to restate personal details—kills confidence. In high-stakes calls, even one transfer is a breach of trust.

The acceptable threshold depends entirely on call intent. Start benchmarking transfer rates not as a general metric, but as a reflection of emotional urgency and transactional risk.

The wrong benchmarks invite the wrong changes

Trying to hit a universal transfer rate target leads to bad decisions. It often means dumbing down routing logic to chase a number.

Telecom and healthcare providers operate under wildly different conditions. They also carry very different customer expectations. Borrowing their benchmarks distorts your own goals.

Internal benchmarking tells a far better story. Don’t aim for one global transfer rate. Break it down by:

- Queue type (e.g., tech support vs. billing)

- Call purpose (simple update vs. complaint escalation)

- Customer segment (consumer vs. enterprise)

Look at outliers within each group. That’s where misalignment lives, not in your overall average.

Visual Table – Suggested Transfer Rate Thresholds by Industry & Intent

| Industry | Call Intent Category | Suggested Max Transfer Rate | Rationale |

| Retail | Order Status | ≤ 15% | Acceptable due to volume and standardization |

| Retail | Refund Dispute | ≤ 5% | Should resolve within original department |

| Financial Services | Fraud Reporting | 0% | Transfer breaks trust and delays security protocols |

| Financial Services | Account Inquiry | ≤ 10% | Allows for some departmental handoffs |

| Healthcare | Appointment Scheduling | ≤ 8% | Transfers should occur only for specialty referrals |

| Healthcare | Insurance Verification | ≤ 20% | Often requires multiple databases or systems |

| SaaS | Technical Support (Tier 1) | ≤ 12% | Acceptable for complex troubleshooting workflows |

| SaaS | Billing Clarification | ≤ 7% | One hop may be fine; more signals tagging or training breakdown |

Numbers above are drawn from anonymized benchmarks across 15 BPO and enterprise service teams.

What a Healthy Transfer System Actually Looks Like

Some transfers are necessary, just make them painless

Eliminating all transfers isn’t the goal. Making them seamless is.

Start with how the handoff happens. A warm transfer, where the agent introduces the next person and shares context, feels like teamwork. A cold one feels like starting over. The customer notices the difference.

Behind the scenes, queue-level transparency reduces handoff friction. When agents know what the next queue covers, they’re not guessing where to send someone. Add in-line context notes to every transfer. The second agent should read the reason before the caller repeats it.

Cross-trained flex agents reduce the need for transfers in the first place. They handle edge cases, catch misroutes, and step in when the customer doesn’t fit a neat box. The more complexity your frontline can absorb, the less painful the escalations feel.

Customers don’t need zero transfers. They need clarity.

The transfer itself isn’t the problem, it’s the confusion around it. The worst moment in any handoff is silence. Customers start wondering: Did the call drop? Am I being sent away?

A simple phrase, “I’m going to transfer you to our billing team. I’ll let them know what you’ve shared”, gives reassurance. It tells them what’s next, why it’s happening, and that the baton won’t be dropped.

Even your IVR can do the same. Instead of “Please hold while we connect you,” try: “One moment, we’re connecting you to someone who handles account security.” That small shift resets expectations and reduces perceived abandonment.

You don’t need to chase a zero-transfer ideal. You need to build a system that never makes a customer feel like they were passed off.

How Voiso Makes Transfer Patterns Transparent (and Fixable)

Real-time dashboard segmentation

You can’t fix a transfer problem you can’t see. Voiso breaks down transfers by what actually matters, agent, call intent, and contact channel. Patterns jump out fast. You’ll know if one agent’s handoffs spike after script changes, or if SMS inquiries keep getting rerouted because the entry point’s unclear.

Routing tweaks should make things smoother. Sometimes they don’t. With Voiso, you can spot when a logic change backfires, immediately. If transfers climb right after a new IVR path goes live, the dashboard catches it before CSAT tanks.

AI routing and transfer prediction

Past behavior reveals future pain points. Voiso uses historical data to predict when transfers are likely, by queue, call reason, even time of day. It flags calls likely to need a second hop and steers them to a better start point.

Some issues need escalation. But many don’t. Voiso routes based on probability of resolution, not just category tags. That means fewer “sorry, let me transfer you” moments, and more calls that end with a solution.

Want to see where your call transfers are costing you trust, and revenue? Request a demo from Voiso.

Don’t Just Minimize Transfers, Make Every One Count

Contact centers that obsess over lowering transfer rates usually miss the point. The real goal isn’t fewer transfers. It’s smarter.

Every handoff tells a story: where intent broke down, where routing missed the mark, or where the org chart made more sense to the business than it did to the customer. Leaders who study those stories build better systems. They don’t hide transfers, they mine them.

The best teams aren’t proud of how few transfers they logged. They’re proud of what they learned from the ones that happened. That’s the real metric.