What does it mean when Thailand tops the world in search interest for call center terms, scoring a perfect 100, while countries like El Salvador, Ethiopia, and the UAE rank higher than the United States? Or when searches for “AI contact center” surged by 350% in just one year?

The past year of Google Trends data reveals a surprising shift in the global call center landscape. Instead of traditional strongholds like the U.S. or Western Europe dominating search interest, the fastest-growing demand is coming from emerging outsourcing hubs, small economies, and rapidly digitizing region.

At the same time, the queries themselves are changing. Businesses are no longer just asking about “call center software”, they’re searching for “call center payments (+500%)”, “staffing software (+250%)”, and even “video call center software (+250%)”. And the steepest climbs of all? Searches tied to “AI-powered solutions”, from “AI call center” (+300%) to “contact center AI” (+350%), show how automation and conversational intelligence are rewriting the future of customer service.

These patterns don’t just reflect curiosity, they highlight where the industry is expanding, which technologies are becoming essential, and which regions are positioning themselves as the next big outsourcing hotspots. For call center and contact center leaders, understanding these shifts is no longer optional; it’s the key to staying competitive in 2026 and beyond.

Key Takeaways

- Search trends show explosive global interest in AI-driven call center solutions, queries like “AI contact center” (+350%) and “Voice AI” (+50%) confirm automation is no longer optional in 2026.

- Outsourcing interest is shifting toward emerging regions like Thailand, Ethiopia, and El Salvador, signaling new BPO hotspots beyond traditional markets.

- Vertical-specific demand is rising fast, especially in healthcare contact centers, while buyers increasingly search for specialized software (payments, video, staffing), making software agility and integration essential for competitiveness.

Why Google Trends Matters for Call Centers

In a fast-moving industry like customer support, Google Trends acts as a real-time pulse of global demand. Every search tells a story: which technologies companies are exploring, which regions are emerging as outsourcing hotspots, and how customer expectations are shifting. Unlike market reports that take months to publish, Google Trends reflects what decision-makers are curious about today.

For call centers, this kind of visibility is invaluable. If interest in AI-powered contact centers spikes by 350% in a single year, it signals that businesses aren’t just reading about automation, they’re actively seeking tools to implement it. When countries like El Salvador, Ethiopia, and Guatemala rank among the top regions for call center searches, it highlights a growing outsourcing shift to new, cost-competitive destinations.

The same applies to broader operational changes. Searches around cloud call center software point to the industry’s ongoing migration away from on-premise infrastructure, while rising queries about remote staffing solutions mirror the global pivot to hybrid and distributed teams.

In short, tracking these search patterns isn’t just about spotting trends, it’s about gaining early intelligence on where investment, innovation, and competition will intensify next. For call center leaders deciding whether to expand into a new market, adopt AI tools, or switch to a cloud-first platform, Google Trends offers a data-driven compass for the road ahead.

Global Hotspots — Where Call Centers Are Trending Most

The past year’s search data highlights some unexpected leaders in call center interest. According to Google Trends, the Top 10 regions are:

- Thailand: 100

- United Arab Emirates: 86

- El Salvador: 86

- Ethiopia: 85

- Ecuador: 81

- Uzbekistan: 72

- Guatemala: 64

- Indonesia: 57

- Honduras: 57

- Chile: 56

What stands out is that smaller and emerging economies dominate the list. Because Google Trends measures search popularity as a share of total queries, not absolute volume, countries with concentrated industry interest often rank higher than global giants.

Each hotspot reflects a different story:

- Thailand and Indonesia are strengthening their positions as regional BPO hubs, fueled by multilingual talent and competitive labor costs.

- The UAE is prioritizing digital transformation, with enterprises adopting AI-driven customer service solutions at scale.

- El Salvador, Honduras, and Guatemala are building momentum as nearshore destinations for North American companies, offering proximity and Spanish-language support.

- Ethiopia’s inclusion signals the rise of Africa as a serious BPO contender, with investments in telecom infrastructure creating new outsourcing opportunities.

Together, these regions show how global demand for call center services is shifting away from legacy strongholds and into markets that combine affordability, talent availability, and technology adoption.

Rising Queries That Define 2026

Search behavior over the past year shows just how quickly the industry is evolving. The biggest risers highlight where organizations are directing their attention and budgets:

AI contact center (+350%)

Generative AI tools, advanced speech recognition, and conversational bots are moving from pilot projects to mainstream adoption. Companies see AI as the fastest way to cut costs while improving 24/7 service.

AI call center (+300%)

Small and mid-sized enterprises, once priced out of automation, are now actively seeking affordable AI solutions. Cloud-native providers are making it easier for these businesses to integrate voice AI without heavy infrastructure.

Contact center software (+130%)

The steady migration from on-premise PBX to cloud-first systems is driving more searches for software platforms. Flexibility, integrations, and scalability are becoming must-haves as remote and hybrid teams grow.

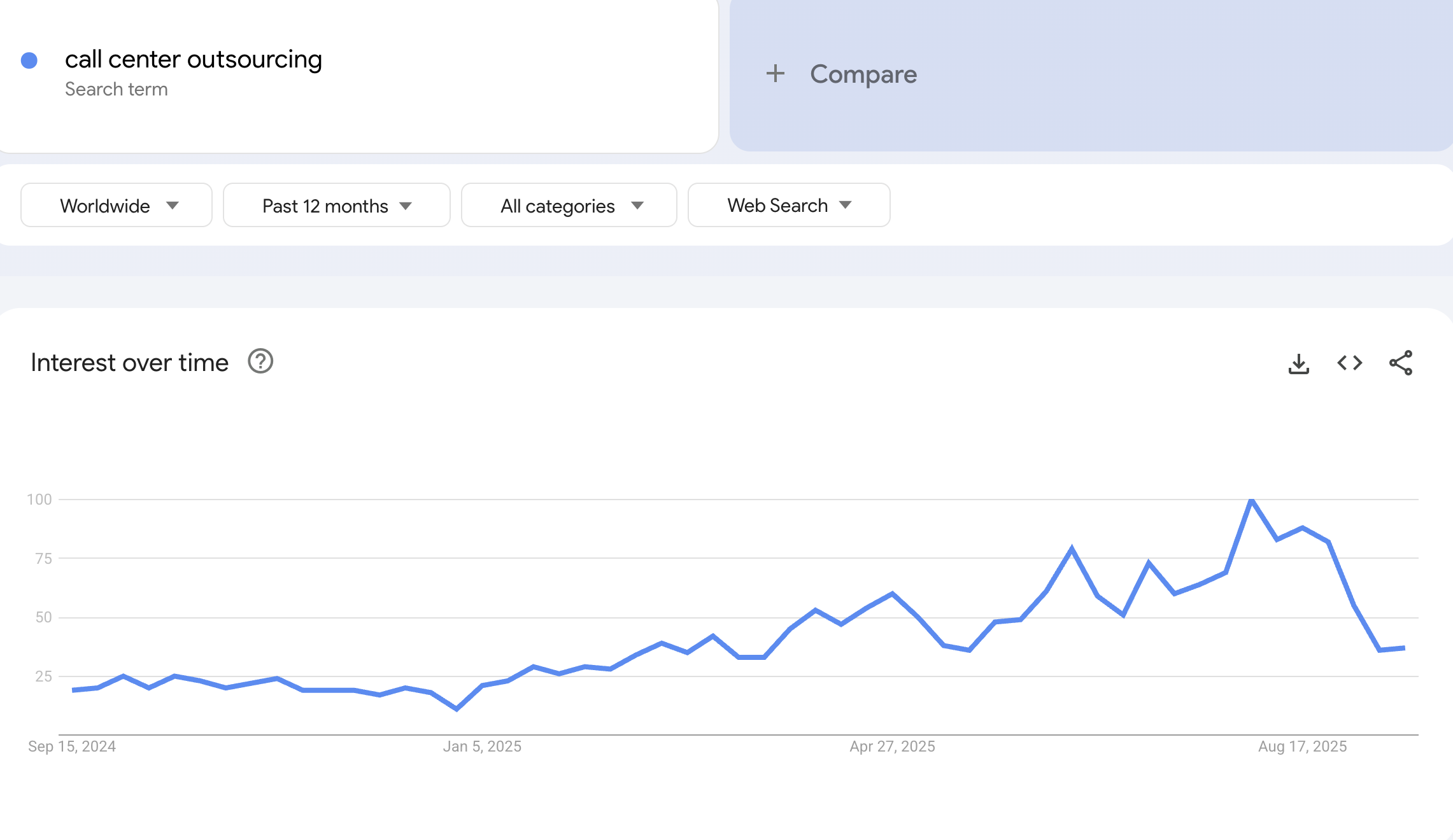

Call center outsourcing (+50%)

Cost-sensitive markets, particularly in North America, are fueling renewed interest in outsourcing. Rising wages at home and the expansion of skilled workforces in emerging economies are making offshore and nearshore options more attractive.

These queries point to a broader reality: AI and cloud technology are rewriting the core of the industry, while outsourcing remains a strategic lever for cost optimization.

Deep Dive by Topic

Beyond overall search volumes, the most revealing insights come when we break trends down into specific areas of the call center and contact center ecosystem. Each category tells us not just what people are searching for, but why demand is shifting and which markets are leading the charge.

Call Center Outsourcing

Top rising queries: call center outsourcing solutions (+200%), top call center outsourcing companies (+70%), call center outsourcing services (+40%)

Top regions: St. Helena (100), Lithuania (41), South Korea (35), Dominican Republic (23), United States (17)

Interest in outsourcing remains strong, but the focus is changing. Searches are increasingly solution-oriented (“outsourcing solutions”) and vendor-driven (“top companies”), reflecting buyers who are closer to a purchasing decision. Regionally, the data shows how both mature economies (U.S., South Korea) and smaller markets (Lithuania, St. Helena) are researching options, often as businesses seek cost relief and scalable service models. For North America and Europe, this trend highlights rising pressure to reduce costs, while offshore markets position themselves as competitive providers.

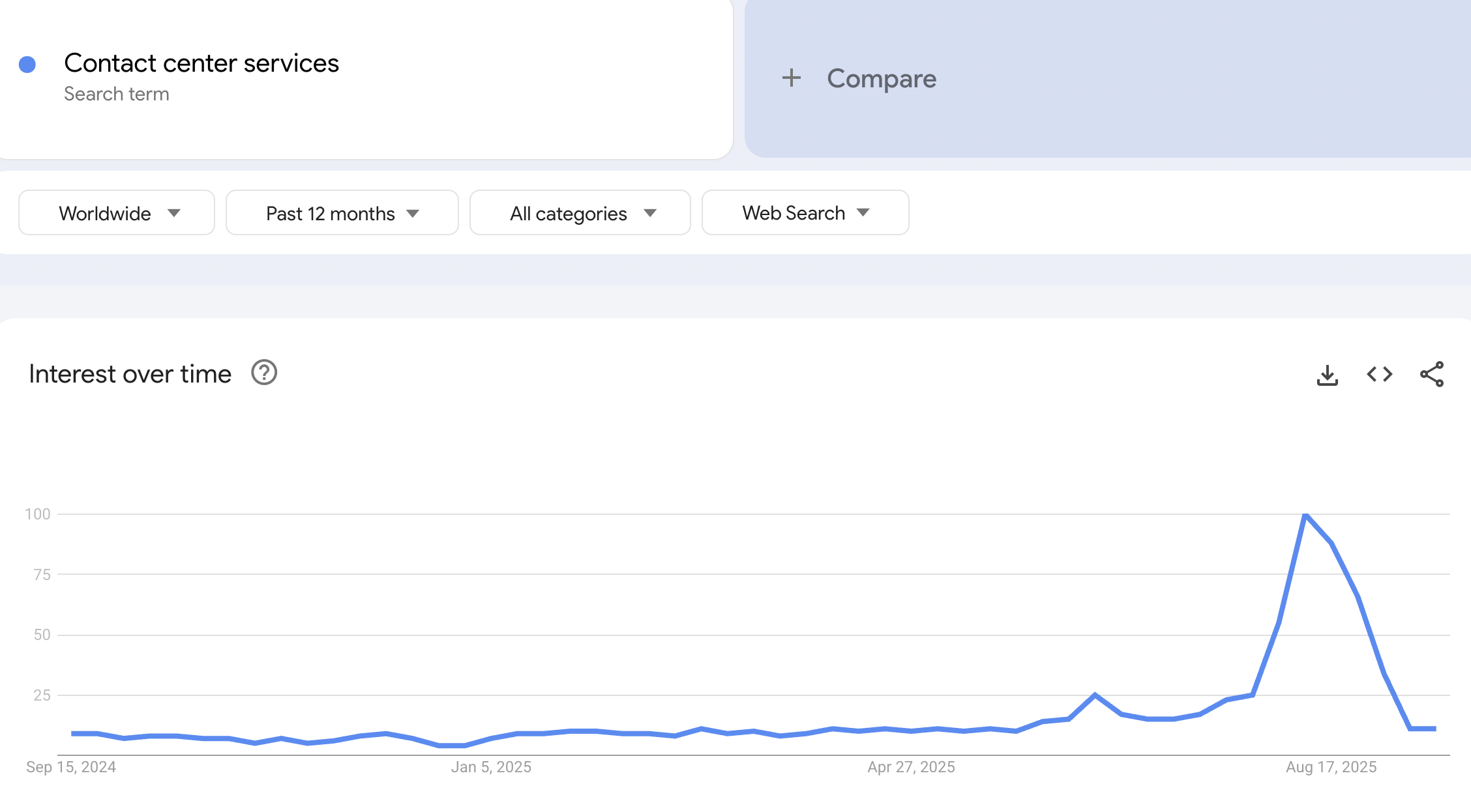

Contact Center Services

Top rising queries: healthcare contact center (+120%), Global contact services (+50%)

Top regions: Philippines (100), United Arab Emirates (50), United States (27), Sri Lanka (22), Pakistan (22)

Healthcare is emerging as one of the fastest-growing verticals for contact center services, with a 120% surge in searches. This aligns with the sector’s increasing reliance on outsourced patient communication, appointment scheduling, and claims support. Regionally, the Philippines continues to dominate thanks to its established BPO infrastructure, while the UAE’s high ranking reflects strong regional investment in digital healthcare. The U.S. shows consistent interest, not as a provider but as the demand side, outsourcing non-core patient interactions to reduce costs and improve responsiveness.

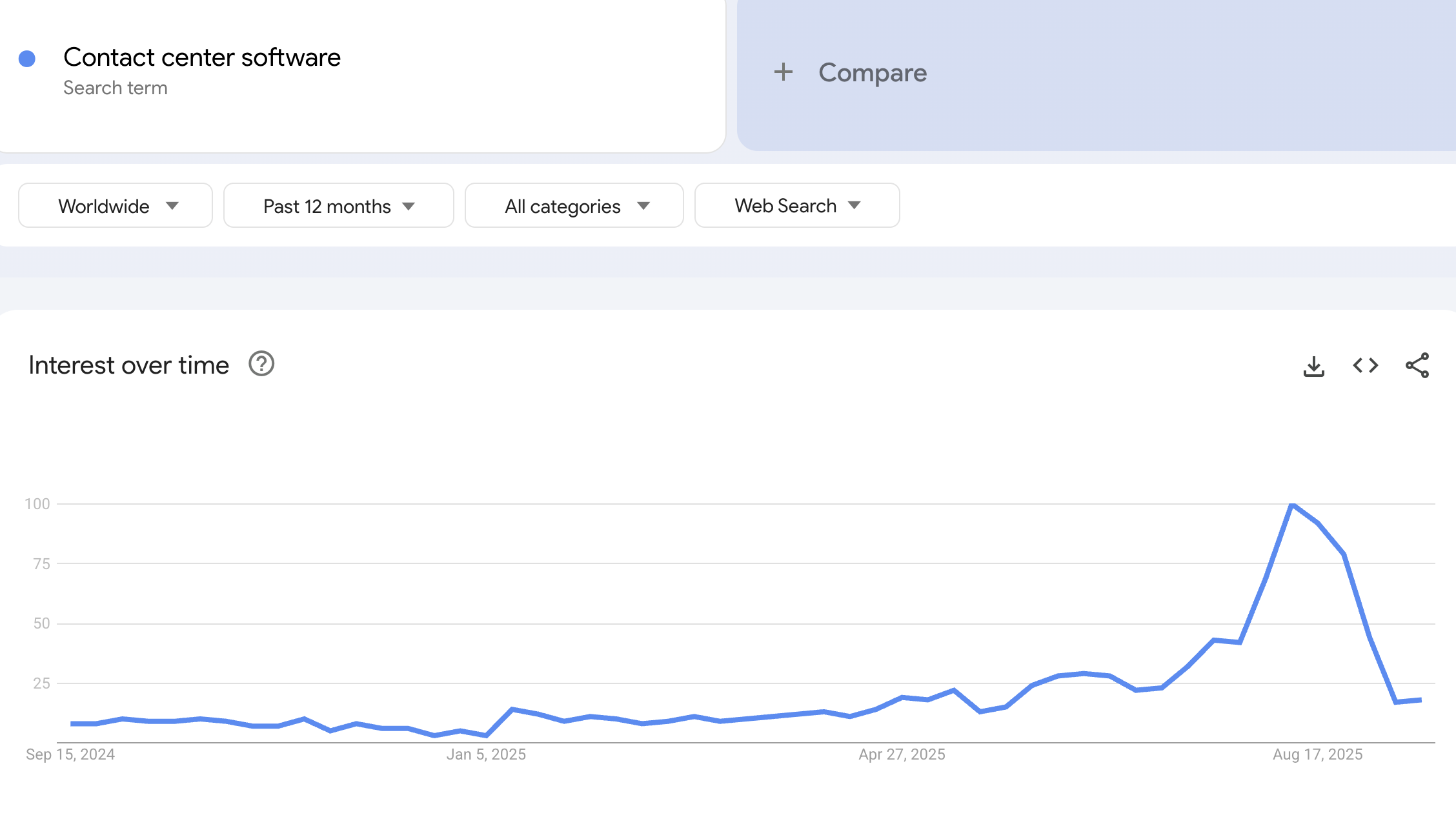

Contact Center Software

Top rising queries: contact center AI (+350%), best contact center software (+160%), contact center software companies (+120%), what is contact center software (+70%)

Top regions: St. Helena (100), South Korea (26), United States (13), Russia (6), United Arab Emirates (6)

The surge in searches around AI-powered contact center software underscores a decisive move away from traditional PBX systems. Organizations are looking for cloud-native platforms that integrate AI for routing, analytics, and customer self-service. South Korea’s strong ranking reflects its aggressive national push into 5G and digital infrastructure, making it a natural adopter of advanced communications tools. Meanwhile, the U.S. remains a key driver of demand, with searches concentrated on identifying the best provider, an indicator of active vendor comparison and potential investment.

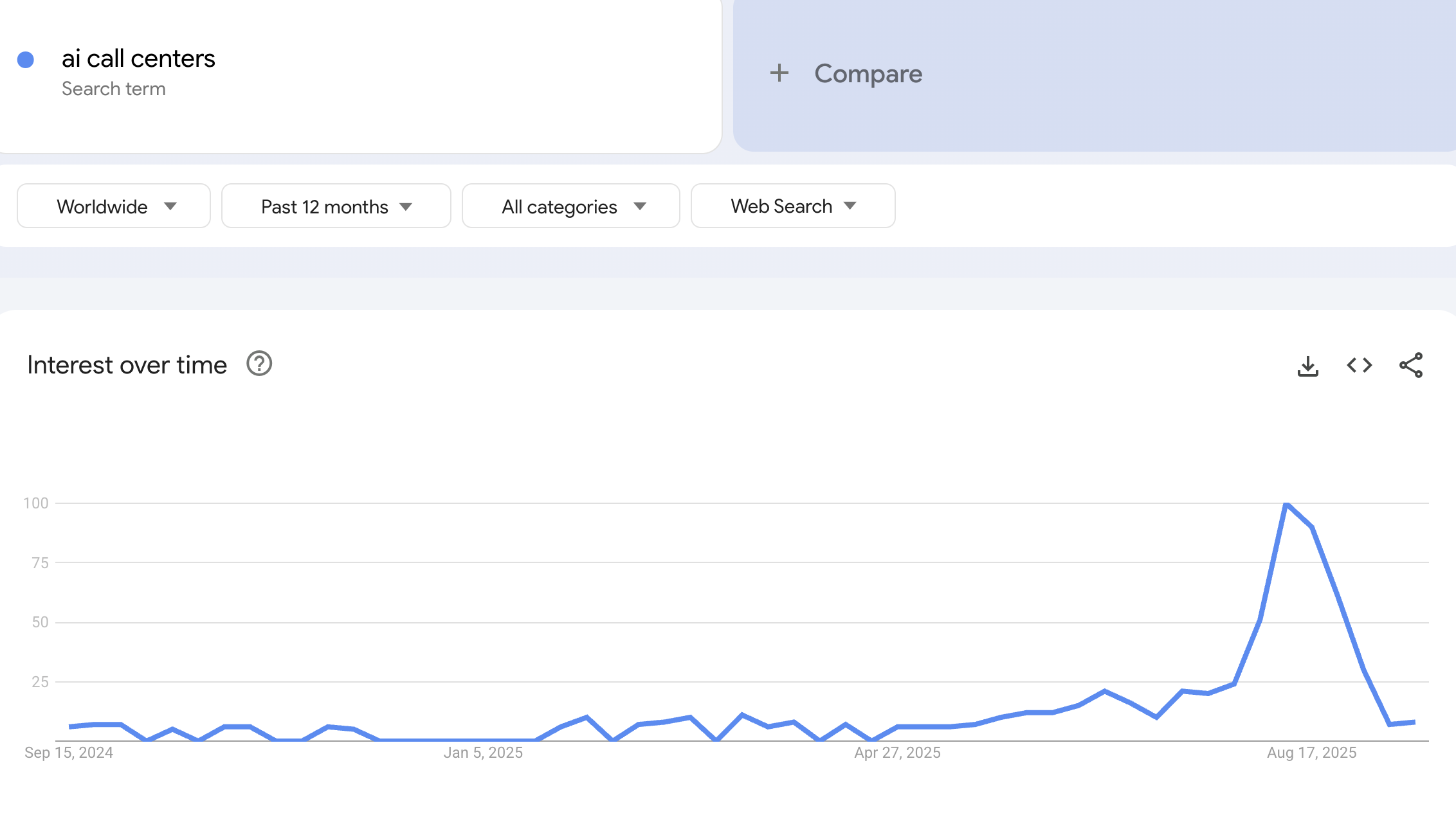

AI Call Centers

Top rising queries: AI for call center (+100%), Voice AI (+50%), Google call center AI (+50%)

Top regions: Liechtenstein (100), Ethiopia (3), St. Helena (2), Philippines (2), United States (2)

Although small in absolute volume, interest in AI-driven call centers is accelerating worldwide. Searches focus on voice AI and branded solutions like Google’s offerings, reflecting curiosity about practical applications of generative AI in live customer interactions. The data also shows how adoption maturity varies: countries like Ethiopia and the Philippines are exploring AI to enhance their outsourcing competitiveness, while in the U.S. the driver is efficiency and scale for large enterprises. The disproportionate score for Liechtenstein highlights how smaller markets can dominate on a proportional basis, even with modest search counts.

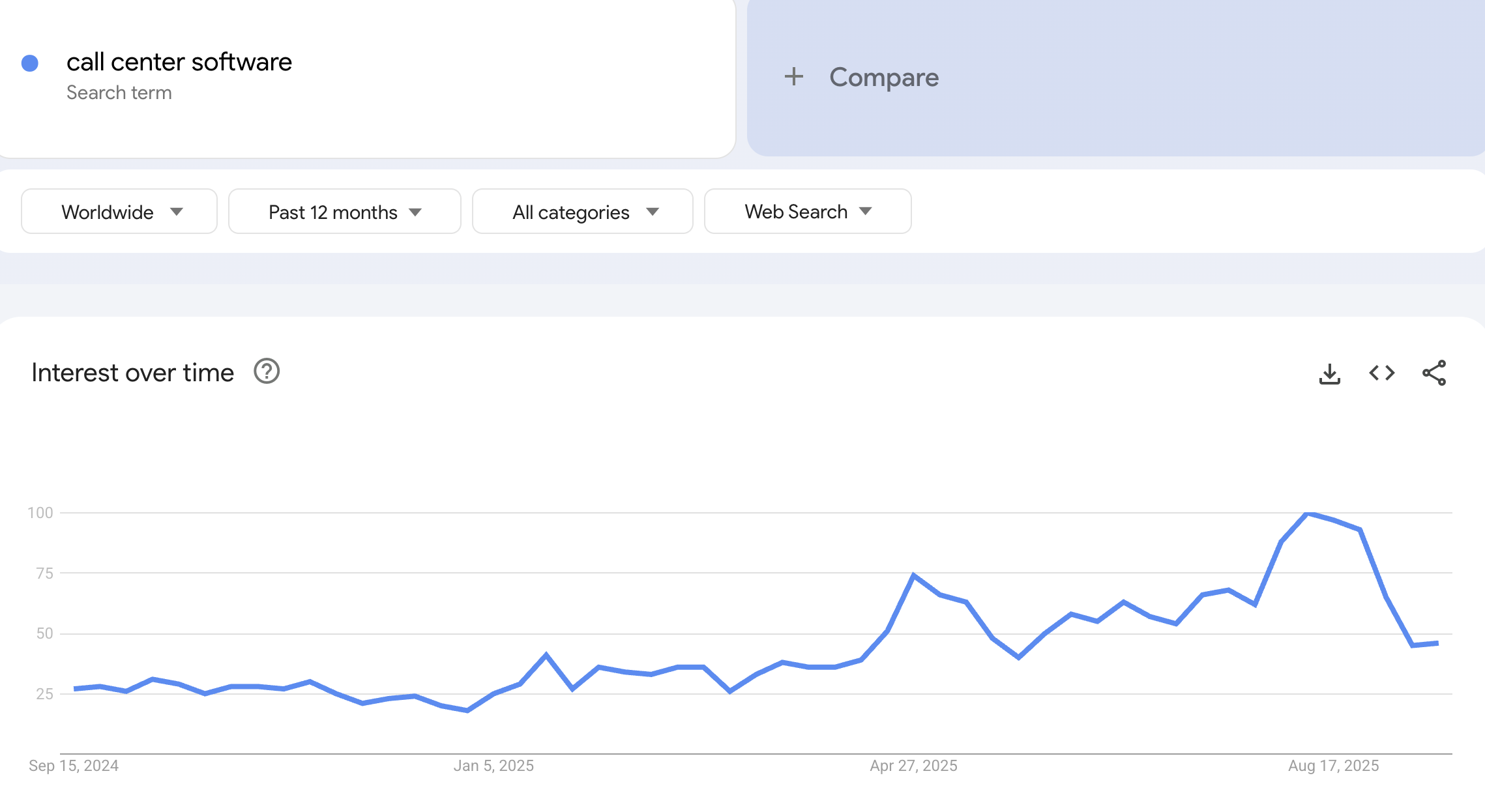

Call Center Software

Top rising queries: call center payments (+500%), call center platforms (+400%), call center software features (+350%), call center staffing software (+250%), video call center software (+250%)

Top regions: St. Helena (100), South Korea (42), Laos (36), Jamaica (29), United States (17)

Beyond core platforms, organizations are increasingly searching for specialized call center modules. The sharp rise in queries around payments, staffing, and video capabilities shows how companies want software that extends beyond voice and ticketing into financial transactions, workforce management, and richer customer engagement. Smaller nations like St. Helena, Laos, and Jamaica rank high on proportional searches, while the U.S. reflects a broader enterprise market actively exploring multi-function platforms.

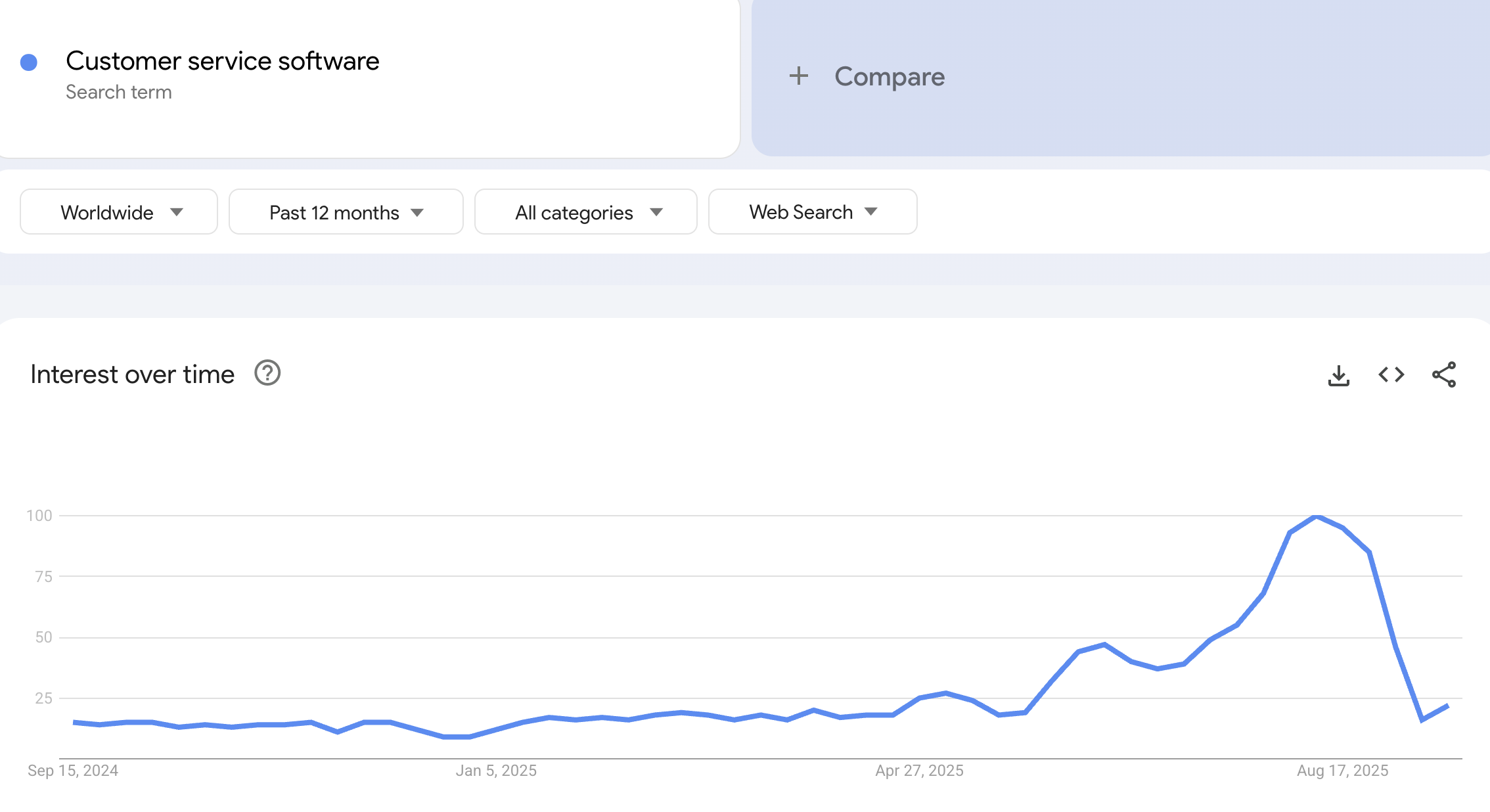

Customer Service Software

Top rising queries: customer service software reviews (+1,100%), customer service automation software (+140%), best customer service software (+120%)

Top regions: St. Helena (100), United States (65), Ethiopia (29), Kenya (23), Nigeria (23)

This category shows a clear purchase-driven intent. The explosive growth in “reviews” searches indicates businesses are actively comparing vendors before making buying decisions. Automation queries reinforce the push toward AI-driven efficiency in customer support, while “best” queries highlight the competitive evaluation stage. Regionally, the U.S. leads demand, but the strong presence of Ethiopia, Kenya, and Nigeria points to Africa’s emergence as a serious BPO hub where companies are evaluating software to serve international clients.

What This Means for Call Centers in 2026

The patterns in search behavior translate directly into strategic priorities for call centers and contact centers:

- Outsourcing demand is shifting toward Central America, Africa, and Southeast Asia, creating new opportunities for providers in these regions and new cost-effective options for enterprises in North America and Europe.

- AI-related queries are skyrocketing, which signals that AI-powered software is no longer optional. Call centers that fail to adopt automation risk losing efficiency, scalability, and client confidence.

- Healthcare is emerging as a hot vertical for contact center outsourcing, with demand driven by patient communication, claims management, and appointment support. Specialized providers can capitalize on this trend.

- The surge in “reviews” and “best software” searches shows that buyers are actively comparing vendors, creating a crucial moment for SaaS providers to sharpen positioning, build trust, and emphasize customer success stories.

Together, these insights highlight where budgets and attention will flow next year, and what call center leaders should prioritize to stay competitive.

Final Thoughts — Building a Future-Proof Call Center

The call center industry is no longer defined solely by cost-cutting or headcount, it’s evolving into a space where AI adoption, vertical-specific services, and strategic outsourcing regions dictate growth. Emerging economies are becoming powerful players, AI is rewriting operational models, and buyers are approaching software choices with greater scrutiny than ever before.

For leaders in this space, tracking search trends isn’t just an exercise in curiosity, it’s a forward-looking signal of where customer needs and competitive pressure are headed. Call centers that pay attention today will be the ones shaping tomorrow.

Track search trends regularly, they don’t just reveal curiosity, they forecast where business will grow.