BDSwiss has been an award-winning purveyor of Forex and CFD investment services since 2012. Used by over a million clients worldwide in 180+ countries, BDSwiss stands out as a leading global financial institution. They offer top-tier platforms, competitive pricing, and top execution on over 250 CFD instruments, which allow traders to profit from price movements without owning the actual assets.

Favorite feature: Omnichannel capabilities- ‘allows seamless communication across various platforms, ensuring all customer interactions are centralized and easily managed.’

Industry: Financial Services

Employees: 450+

Location: Switzerland

Key Takeaways

- Challenge: BDSwiss faced dropped calls, poor voice quality, and inconsistent communication, negatively impacting customer experience in the fintech industry.

- Solution: Voiso’s omnichannel platform enhanced reliability, ensured uninterrupted service, integrated with trading systems, optimized security, and scaled with company growth.

- Operational Improvements: Automation and CRM integration cut average call handling time by 30%, reduced operational costs by 25%, and increased agent productivity by 20%.

- Enhanced Customer Experience: Unified communication across voice, SMS, and apps like WhatsApp improved engagement, reduced repetition, and boosted customer satisfaction by 15%.

- AI-Powered Features: Answering machine detection (AMD) and intelligent call routing increased efficiency, ensuring agents focus on live, high-value interactions.

- Global Reach: Cloud-based platform with local numbers in 120+ countries enabled seamless service for a growing international client base.

- Fintech Benefits: Voiso’s omnichannel, AI, and cloud capabilities help financial institutions reduce costs, improve productivity, maintain consistency, and support sustainable global growth.

Overview

Challenge

Before adopting Voiso, call inconsistency was a major issue for BDSwiss. Frequently dropped calls, less-than-ideal voice quality and choppy audio undermined communication reliability and call experiences – a critical factor in the fintech industry.

Solution

BDSwiss sought a tool that could enhance reliability and talk time, ensure uninterrupted service, optimize security and compliance, seamlessly integrate with trading platforms, and scale effectively with the company’s growth.

Result

Voiso’s automation features have cut BDSwiss’s average call handling time by 30% and reduced operational costs by 25%. Agent productivity is up 20% thanks to Voiso’s reporting and analytics tool, and the ability to resolve calls quickly has improved customer satisfaction by 15%.

How Voiso improved BDSwiss’ metrics

Agent productivity and ROI

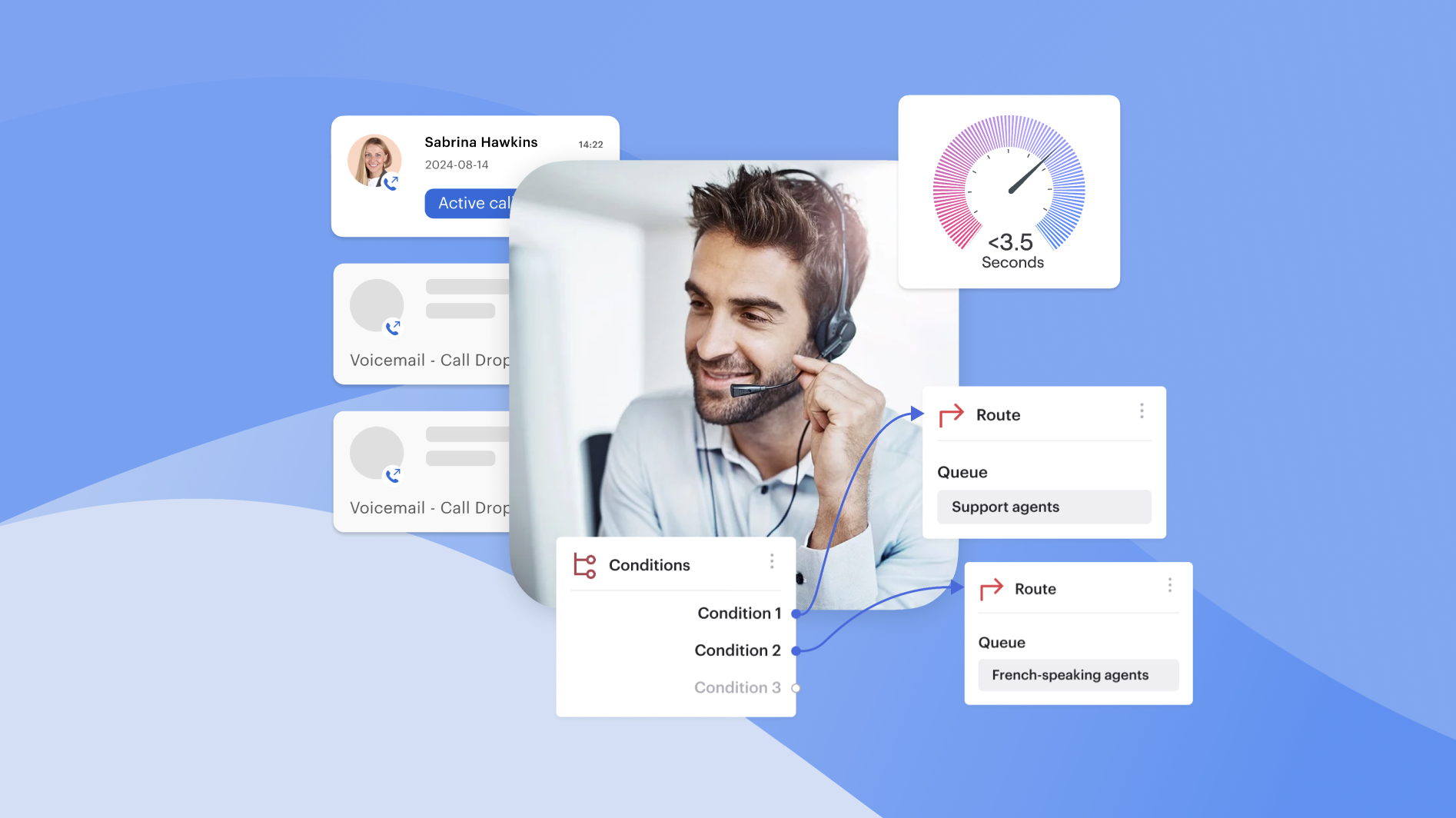

Answering machine detection has significantly boosted both agent productivity and ROI for BDSwiss by ensuring that agents spend more time on live customer calls. This means more targeted interactions, fewer unnecessary calls and less stressful experiences, leading to:

Enhanced customer satisfaction: Since adopting Voiso, customer satisfaction scores have gone up by 15%. Having customer information readily available, along with the CRM integration, reduces resolution times and boosts first-call resolution rates for agents.

Cost reduction: As an all-in-one platform, Voiso has enabled BDSwiss to cut down on multiple software subscriptions, saving them over 25% in operational costs. Plus, the improved efficiency means less overtime hours, which cuts down on costs even further.

Improved customer connections and expanded market reach

By leveraging local numbers in 120+ markets during their global expansion, BDSwiss was able to provide exceptional, personalized service to its growing customer base. Voiso’s automation features also streamlined operations, resulting in:

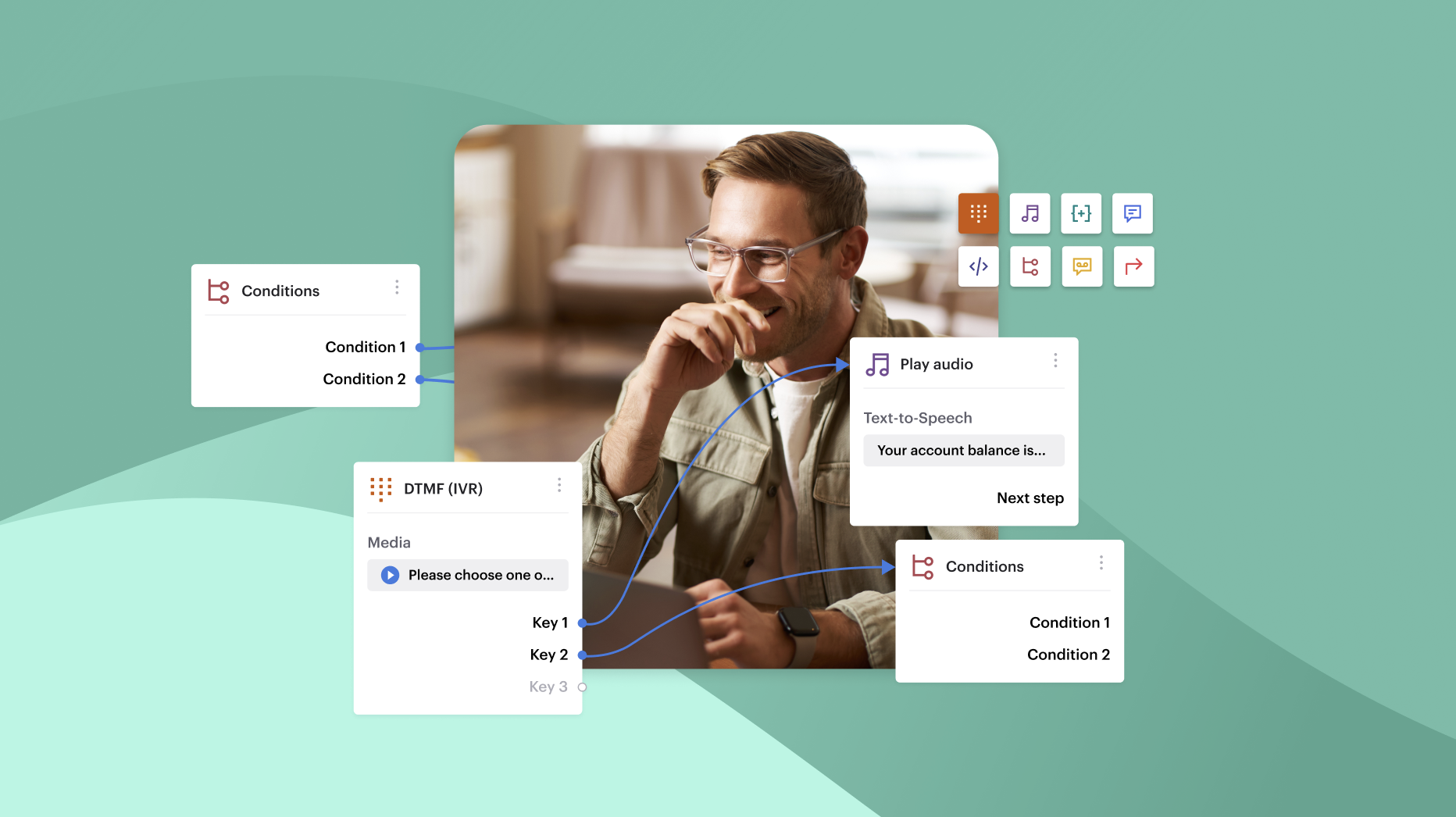

Time saving: Average handling time has been reduced by 30% thanks to Voiso’s call routing and CRM integration. Agents used to spend considerable time on manual input and tasks that have now been streamlined and automated through Voiso’s system.

Customer engagement

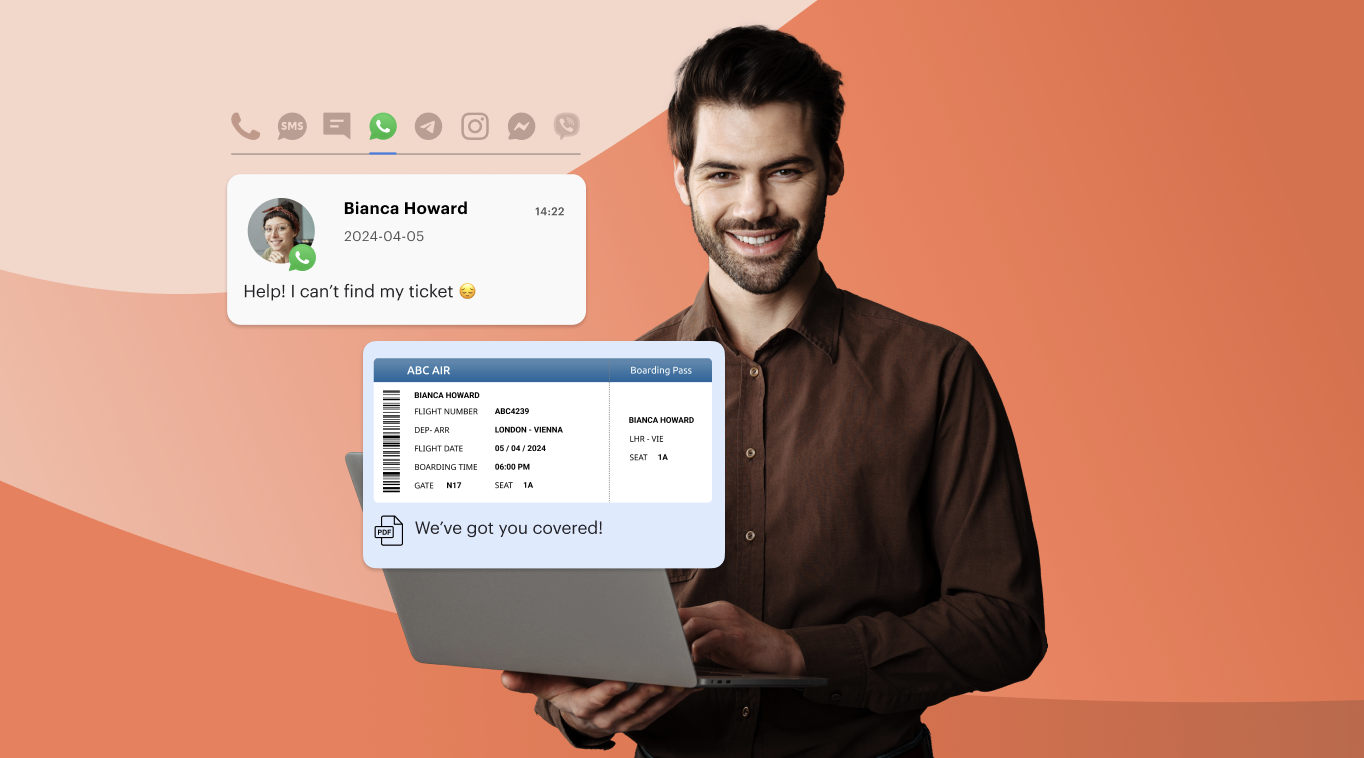

WhatsApp allows BDSwiss to instantly respond to customers with personalized messages. Sharing media — such as images, videos and voice messages — allows for more personalized interactions, while Voiso’s Omnichannel toolkit keeps customer interactions unified on a single interface. This has resulted in consistent communication and reduced the risk of customers having to repeat themselves when switching channels, paving the way for:

Increased productivity: With access to real-time data and performance metrics, agents have been able to optimize their workflows and focus on more high-priority tasks, which has resulted in a 20% increase in agent productivity across the board.

Why fintech companies choose Voiso

#1 Seamless Inbound

Voiso’s omnichannel functionality can massively improve brand consistency and customer satisfaction by unifying communication channels on a single platform. Businesses can manage interactions via voice calls, SMS and even third-party messaging apps like WhatsApp and Instagram in the same place, streamlining operations and improving customer service. Every trader receives the same level of support, no matter how they choose to connect.

#2 Optimized Outbound

Our AI AMD feature identifies and skips over the 78% of cold calls that go to voicemail, ensuring your agents only connect with live prospects. Time saved on avoiding unnecessary answering machine interactions translates to increased productivity, reduced operational costs, and more efficient resource allocation.

#3 Global Reach

Voiso’s cloud-based solution offers flexibility that is ideal for businesses operating across multiple markets. With access to local phone numbers in 120+ countries, Voiso supports seamless global expansion, allowing companies like BDSwiss to easily manage millions of worldwide traders. Our cloud infrastructure eliminates the need to switch providers or invest in additional hardware, allowing our solution to grow alongside your business, meeting your growing needs and expectations every step of the way.

The bottom line

Voiso is dedicated to becoming the leading provider of call center software for the fintech sector, offering solutions for streamlined, optimized communication. We empower financial institutions to scale their growth sustainably while maintaining optimal customer satisfaction. With Voiso, your business can simultaneously enhance its customer service capabilities and drive global growth. Are you ready to level up your customer service? Talk to us today to see how we can help you conquer new markets.